Ensuring you are prepared for the unexpected.

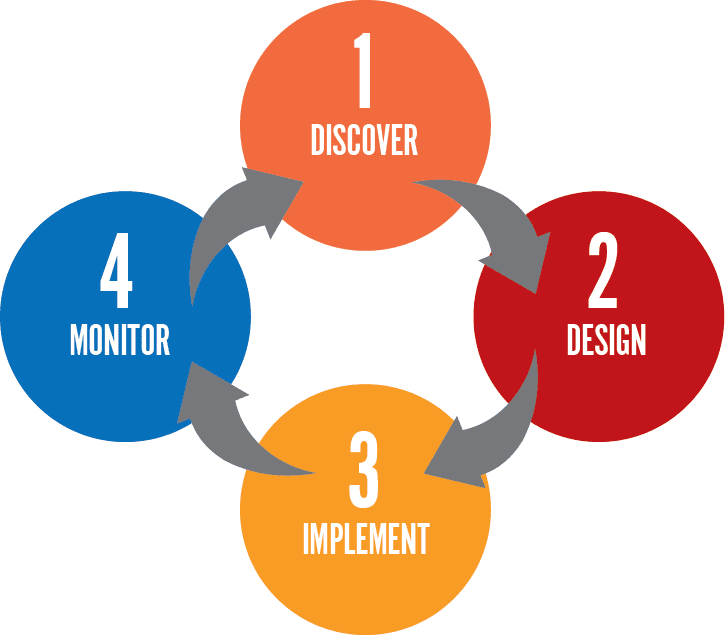

Our Four-Step Process

We operate in a constantly changing business and regulatory environment. A haphazard approach to insurance leads to gaps in coverage, inappropriate limits, and higher costs. At Rue Insurance, we have instituted this process to ensure your insurance needs align with your changing business.

The purpose of our risk reduction approach for business risks and total benefits approach for employee benefit programs is to minimize your total cost of risk and improve your profitability. Our process is an ongoing system that can help decrease operating costs and fosters long-term relationships.

Discover

We continually take an in-depth look at your situation. We don’t just build on an existing program, we start from square one. A thorough and complete review of the company is the ideal way to discover potential risks.

Design

The discovery phase uncovers the information necessary to create a custom program for your business. This program will be designed to manage the risks your business may encounter.

Implement

Rue executes a plan of action tailored to your business. When followed throughout the year, this plan allows for an efficient approach to meeting defined goals and deadlines relevant to your company’s success.

Monitor

We refine the plan of action on a regular basis. Our continued involvement and interest in your success displays our dedication to you—long-term. Too often, gaps are perpetuated due to lack of communication and review.

Family Ready. Business Ready. Life Ready.

Be READY with RUE…

Be READY to have someone listen to YOUR needs.

Be READY to have YOUR questions answered.

Be READY to have YOUR valuable assets protected.

Be READY to have YOUR concerns resolved.

Be READY to have YOUR fears addressed.

Be READY to have YOUR dreams realized.

…Be READY with RUE.

Watch Our Videos

Stay updated on the latest from our agency by subscribing to our Youtube channel.

Click it. Read it. Cover it.

Get a glimpse of the risks you face and how your insurance can protect what matters most.

Every business faces risk. The level and type of risk will vary based on multiple factors including industry, size, and location, among others. Risk can never be fully eliminated, but it can be reduced.

Risk management is the practice of taking proactive steps to identify and mitigate risk. It’s a broad topic that involves many areas of a business, from personnel and technology to safety and compliance. Risk management can not only help a business identify what risks need to be insured, it can also pinpoint ways to reduce.

Staying compliant is hard. The laws for many facets of business are ever-changing. Employee handbooks can become out of date. Employment and other contracts can contain problematic language if not handled properly. Employee relations and human resources concerns can get complicated.

There are insurance coverages like employment practices liability insurance (EPLI) and directors and officers liability insurance (D&O) that can help pay for the legal costs of defending lawsuits against the business, but risk management can help shed light on areas of the business where process improvement and consistent practices could help avoid litigation.

Employees can make mistakes for a number of reasons. Sometimes, it’s simply the result of a lack of education. Some businesses may choose to skip training because they don’t have the time or resources to devote, but this can lead to mistakes and accidents.

Conducting employee training can reduce risk. For example, sexual harassment training often helps businesses avoid lawsuits. Safety training is essential to avoid workplace injuries. Many insurers will help companies provide employee training as a cost-saving measure.

The Occupational Safety and Health Administration (OSHA) sets and enforces standards aimed at ensuring the environment in which employees work is safe and healthful. Employers are required to comply with these standards and OSHA may audit workplaces to verify compliance. Employers that fail to comply can be faced with hefty fines.

Lockout/tagout, hazard communication, and powered industrial trucks standards, among others, all require specialized programs. Utilizing outside resources to create and train employees on these programs can be a cost-effective solution that ensures your business is doing everything possible to meet required standards.

If your business involves driving, you know that safety is paramount. Failure to drive safely not only endangers the lives of your employees and the general public, but it can also have costly repercussions for the business.

Increasing driver safety is a cost-effective risk management tool. Classes and seminars can be effective resources. Telematic programs allow businesses to see every move a driver makes. Driving simulators can offer hands on training for drivers of trucks, school buses, agricultural haulers, and other vehicles to prepare them for scenarios they may face out on the road.

When it comes to weather and natural disaster related losses, where your business is located impacts the kinds and level of risk it faces. Fires, hurricanes, blizzards, tornadoes, earthquakes and other events can cause major losses to your business.

While it’s impossible to control the weather, it is possible to lower the risks the weather poses. Risk management involves assessing which events are most likely and what steps a business can take to protect their building and contents, their employees, and other systems.

Technology failures can be extremely detrimental to an organization. Problems can arise from power outages or surges, cyber-attacks, or telephone and communication failures.

Understanding what risks the technology your business uses is susceptible to, the processes a tech failure could affect, and how to prevent losses from tech failures is an essential part of risk management. This can help determine the proper insurance policies that are needed, such as cyber liability, property, and business interruption coverage.

Risk Management 101

Make sure you cover the unique risks you face with risk management solutions.

- Click on the hotspots.

- Discover your risks.

- Get the right coverage.

“Top Notch has been doing business with Rue Insurance for several years now and we are very happy with the service they provide to our team. Rue ensures that all of our insurance needs are met and their staff is always very helpful anytime we have questions or concerns.”

Grace L.Small Business Insurance Client

“I’ve worked with Rue for the past several years. The staff is very professional and always available whenever you have a question or need anything. I highly recommend them.”

Lynn Z.Personal Insurance Client

“Rue Insurance provided business insurance in support of my consulting engineering practice. The service that they provided was outstanding. I would recommend them without hesitation.”

Gerry P.Small Business Insurance Client

“My experience with Rue Insurance has been incredible. They were able to save me and my family a considerable amount with our home and auto, and their customer service is top-notch as they promptly returned emails and calls.”

Anna D.Personal Insurance Client

The independent agency difference.

Why Choose Rue Insurance?

- We represent multiple insurance companies.

- We are licensed insurance advisors.

- We are by your side every step of the way.

- We offer a wide variety of insurance solutions.

- We are there for you in your time of need.

Remarkable

A unique, non-traditional approach to insurance.

Easy

A single source for all insurance product needs.

Advisors

A comprehensive, 4-step process to identify and manage risk.

Dependable

A local institution for over 100 years.

You (Our Clients)

A custom solution because it’s all about your needs.

Contact Rue Insurance

We’re here to provide the advice you need to protect what matters most.

We offer insurance solutions throughout NJ, PA, and NC with a focus in Mercer, Bucks, Burlington, Middlesex, Monmouth, Ocean, and Somerset counties. We are also licensed in NY, DE, and most other states across the country.