In New Jersey, people who own a car or truck are required to purchase Auto Insurance. New Jersey is one of a handful of states that require Personal Injury Protection (PIP) coverage be included under auto insurance.

PIP has a variety of different coverage provisions, the chief of which is paying for medical bills you incur from an auto accident. If you are a driver, passenger, or pedestrian hit by a car, PIP coverage will automatically pay for your medical bills, regardless if you are at fault for the accident.

Limits & Deductibles

When you first purchase coverage you must pick a limit. The standard limit is $250,000. However, you can purchase lower limits down to $15,000. I would caution you on the implications of buying lower limits. If you have severe injuries from being in an accident you can easily exhaust a limit of $15,000. Once that limit is gone, you can seek coverage under your own health insurance, however, some health insurance plans don’t cover auto accidents. If you choose to buy lower PIP limits to save premium, check with your health insurance company to see if it will cover your medical bills if you are in an auto accident.

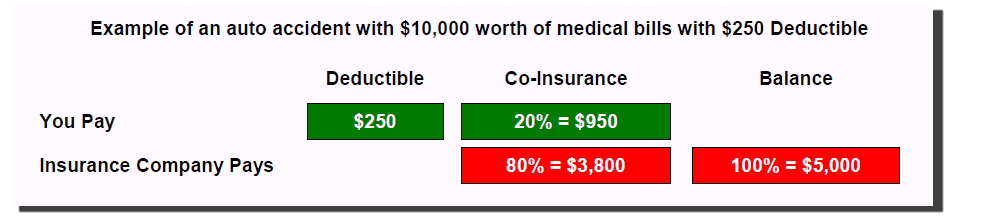

After you select your coverage limit, you must choose a deductible amount. A standard deductible is $250. However, you can purchase a higher deductible up to $2,500. If you have a PIP claim you pay the full deductible out of your own pocket. After that you will pay 20% of each additional medical bill up to $5,000 worth of medical bills generated from the accident. The 80% difference between your deductible and $5,000 is paid by the insurance carrier. Therefore, if you purchase a $250 deductible, the most you will pay out of pocket is $1,200. If you purchase a $2,500 deductible, the most you will pay out of pocket is $3,000.

Here is an example of how it would look:

Other Coverage’s

PIP coverage also relates to time out of work on disability. A basic policy will give you a small amount of coverage for lost wages due to being out of work from an auto accident. Basic policies provide $100 per week, up to one year. However, you can buy a higher weekly amount.

PIP also provides a small amount of coverage, for $12 a day for Essential Services. This pays for someone to help cook or clean for you while on disability.

A Death Benefit of $5,200 in included, along with $1,000 of funeral expenses if you die as a result of injuries from a car accident.

Uber & Lyft Drivers/Passengers

Coverage applies differently if you are driving a car while picking up a passenger for transportation services like Uber or Lyft or if you are a passenger in a Uber or Lyft ride. I wrote about this in a different blog post.

Byer Beware

Beware – insurance companies that sell insurance via a website or so called “Name Your Price” tool sometimes lower the amount of PIP coverage to reduce premium, but they don’t make this decrease in coverage obvious.

If you have any questions about this important coverage, drop us a line.