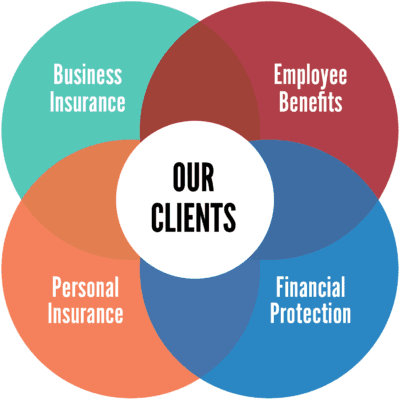

Coverage and risk management solutions for companies of all sizes.

Business insurance provided by Rue Insurance.

Home »

In today’s ever-changing environment, risk is constant. Business insurance isn’t. We’ll thoroughly assess your business and situation to develop creative, comprehensive, cost-effective solutions that fit your needs.

Rue Risk Services | Our Process

Rue offers custom insurance programs for businesses in a number of industries and locations. Our 4-step risk reduction process helps to decrease your total cost of risk and make your company more attractive to the insurance marketplace. This process assists in placing you with an excellent insurance company, which can have a positive impact on your profits.

Whether it’s the traditional or alternative markets, Rue has the experience and expertise to help you protect your assets. We are able to offer a level of service and expertise unmatched by others in the industry. We provide individual attention and the expertise of being in the insurance business for over 100 years.

Insurance by Industry

Looking for insurance designed specifically for your business? Search for business insurance by industry to find the right coverage.

Request Information on Business Insurance

We’re here to provide the advice you need to protect what matters most.

Request an Evaluation

It only takes a minute to get started.

- Fill out the form, we’ll be in touch.

- Go over your options with an agent.

- Get the coverage you need.